Diversify and Stabilize with Treasury Securities at OrixWealth

Investing in treasury securities offers a strategic avenue for portfolio diversification, providing stability and predictable returns. OrixWealth is committed to guiding investors through the intricacies of treasury investments, ensuring informed and confident decision-making

Our approach focuses on understanding the factors driving index movements and how these might relate to your unique financial goals and portfolio structure. We use index data as one tool among many to inform our strategic advice and help you navigate market complexities, always prioritizing your long-term objectives.

Why Consider Treasury Securities?

Treasury securities, including Treasury Bills (T-Bills), Treasury Notes (T-Notes), and Treasury Bonds (T-Bonds), are government-backed instruments known for their reliability. They serve as a cornerstone for investors seeking to balance risk and return in their portfolios.

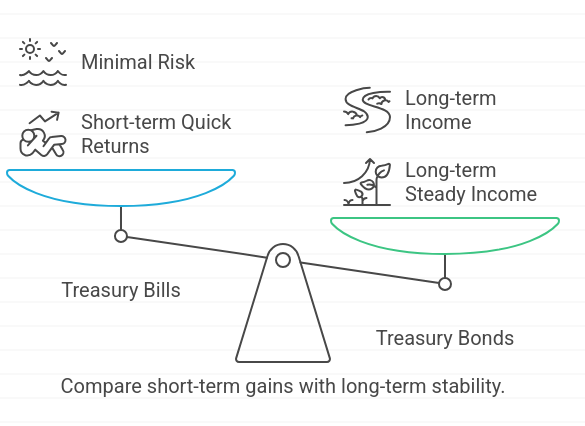

- T-Bills: Short-term instruments maturing in one year or less, ideal for investors seeking quick returns with minimal risk

- T-Notes: Medium-term securities with maturities ranging from 2 to 10 years, offering semi-annual interest payments.

- T-Bonds: Long-term investments maturing in 10 to 30 years, suitable for those aiming for steady, long-term income.

OrixWealth Advantage

Unlike traditional platforms, OrixWealth lets you trade on Treasury CFDs, giving you the flexibility to go long or short — with no need to own the asset. You gain access to over 90+ government bonds and interest rate products from markets across the U.S., Europe, Asia, and Canada.

Frequently Asked Questions (FAQs)

What Are the Different Types of Treasury Securities Available?

What Are Bonds?

Is a Treasury Bond a Good Investment?

Where Can I Buy Treasury Bills/Bonds?